What began in the AIDS crisis as a way to cover impossible medical bills—the viatical settlement—is now quietly helping cancer patients turn insurance policies into cash for care and stability.

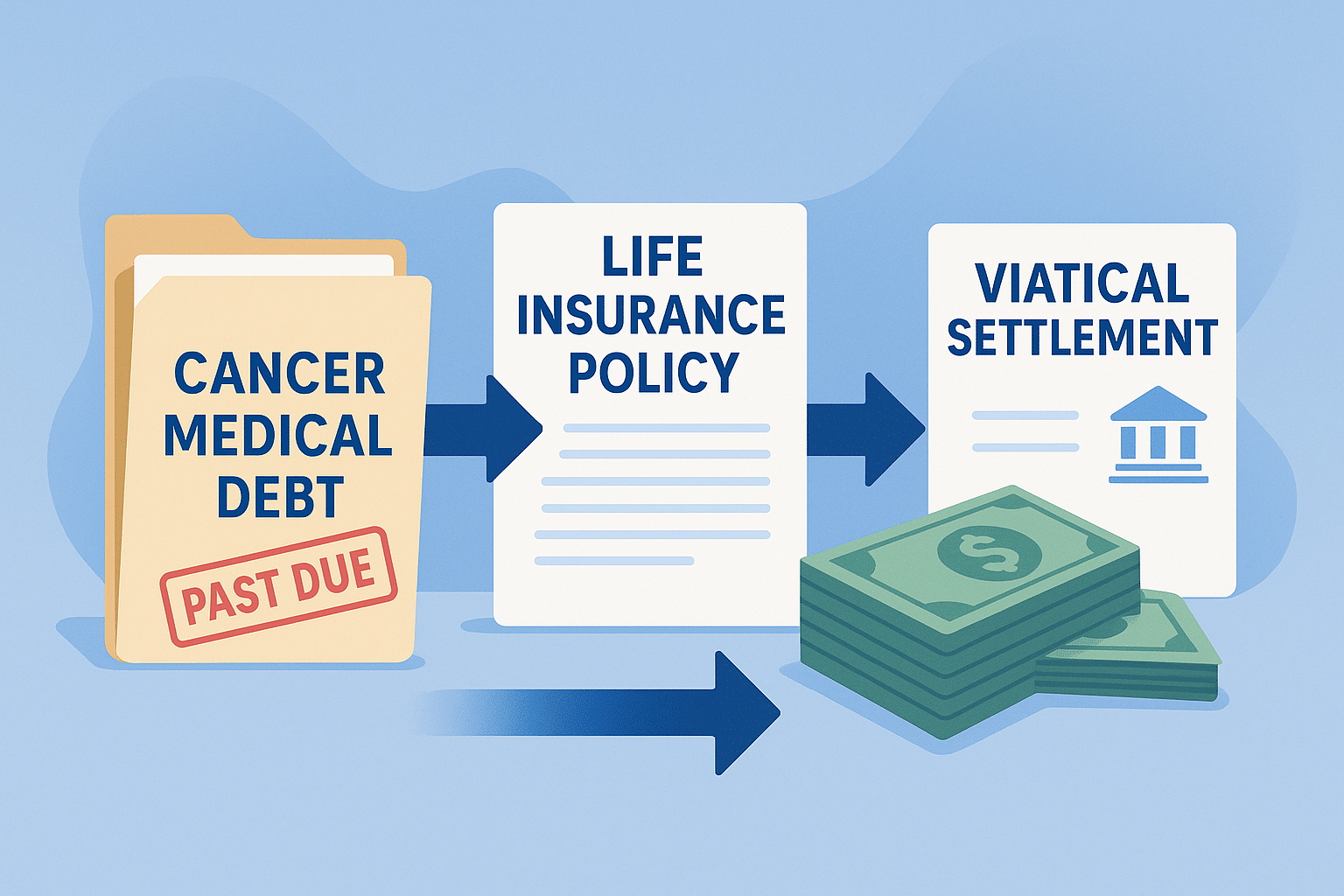

Cancer is expensive in ways most people don’t see coming. The treatments themselves carry staggering price tags, but that’s only the beginning. Insurance doesn’t cover everything, even on the best plans. Families end up draining retirement accounts, pulling equity from their homes, and using credit cards to keep up with bills. What was once savings for the future is suddenly gone just trying to get through the present.

This isn’t new in America. In the 1980s, when the AIDS crisis hit, thousands of men faced the same kind of financial devastation. They were young, often without much savings, and most were denied insurance coverage. Out of that desperation came something called a viatical settlement.

The arrangement was straightforward: an investor or a company would pay a portion of the value of a person’s life insurance policy, take over the premiums, and be named the beneficiary. For people dying of AIDS, it meant access to immediate cash—money that could cover medical costs, pay the rent, or even finance a final trip or small dream. For some, it brought a measure of comfort and dignity in their last months; for others, it allowed them to leave something behind for those who had stood by them. For the investors, however, profit depended on how long the patient lived—and how long they’d have to continue paying premiums before collecting the policy’s full value.

That history is being retold in Matt Nadel’s new Oscar®-qualified documentary, Cashing Out, which premiered on The New Yorker’s platforms. The film shines a light on how people living with AIDS turned life insurance into a lifeline, and how an entire industry grew out of those early years. Produced with the support of the National AIDS Memorial, it reminds us that progress in health care is fragile, and that the financial strain of serious illness has never disappeared.

For people with cancer today, the parallels are impossible to ignore. Treatments have advanced dramatically, but the money questions remain the same. Families sit at kitchen tables with stacks of bills, asking how they’ll pay for another round of chemotherapy or whether they can afford to try an integrative therapy that insurance won’t touch. And once again, viatical settlements are one of the few options on the table.

The process now is more regulated than it was in the 1980s. A patient can sell their life insurance policy for immediate cash, often through organizations like Cancer Care Financial. The money can be used for anything—medical treatment, mortgage payments, even just easing the day-to-day stress of living with a serious diagnosis. It’s not charity, and it’s not a loan. It’s a way of turning a policy that might otherwise lapse into something that can actually help while you’re alive.

Critics still wrestle with the ethics of it. They see it as putting a price on mortality. But for patients, it’s often the most straightforward choice available. Unlike insurance appeals or bank loans, a viatical settlement doesn’t involve waiting months for an answer. It provides clarity and, most importantly, cash at a time when every week matters.

The story told in Cashing Out is a reminder of what happens when illness collides with financial systems that were never built for patients. AIDS forced a generation to find new ways to pay for survival. Cancer is forcing families to do the same now. The names and diseases may be different, but the lesson is the same: without real support, people will find their own solutions, even if it means selling the future to survive the present.

Cancer costs more than money. It costs stability, peace of mind, and the ability to plan for tomorrow. But the history of viatical settlements—and their continued role today—shows that even in the harshest financial realities, people will look for dignity and a way forward. Sometimes, the only option is to cash out.

People Also Ask

What is a viatical settlement?

A viatical settlement allows someone with a serious illness to sell their life insurance policy for cash while they are still alive. The money can be used for treatment, living expenses, or other personal needs.

How did viatical settlements start?

The industry began during the AIDS crisis in the 1980s, when patients sold their life insurance policies to afford medical care, housing, or to leave money behind for loved ones.

Can cancer patients use viatical settlements?

Yes. Many cancer patients use viatical settlements today to help cover high treatment costs and day-to-day expenses that insurance and savings can’t fully cover.

What’s the difference between a viatical settlement and a life settlement?

A viatical settlement is for people with a terminal or serious chronic illness. A life settlement is usually for seniors who no longer want or need their policy.

Where can I learn more about viatical settlements?

Organizations such as Cancer Care Financial provide information and services to help patients understand how the process works and what options are available.

FAQ

What is a viatical settlement and how does it work?

A viatical settlement is when a person with a serious illness sells their life insurance policy for cash. The buyer pays the policyholder a lump sum, takes over future premium payments, and becomes the beneficiary. For patients, it means immediate funds that can be used for treatments, bills, or simply peace of mind.

Why did viatical settlements start during the AIDS crisis?

In the 1980s, people with AIDS faced crushing medical costs and were often denied insurance. Selling life insurance policies became a way to cover expenses, support loved ones, and live their final months with more dignity. This practice became the foundation of today’s regulated viatical settlement industry.

Are viatical settlements only for AIDS or cancer patients?

No. While they began during the AIDS epidemic and are widely used by cancer patients today, viatical settlements are available to people with a range of serious or terminal conditions who own qualifying life insurance policies.

What’s the difference between a viatical settlement and a life settlement?

– Viatical settlement: For people with a serious or terminal illness, regardless of age.

– Life settlement: Usually for seniors (65+) who no longer need their life insurance, even if they are healthy.

How much money can I get from a viatical settlement?

It depends on the size of your policy, the premiums, and your medical condition. Settlements are typically much higher than a policy’s surrender value but less than the full death benefit. Each case is unique.

Where can I get trustworthy information about viatical settlements?

Specialized providers like Cancer Care Financial focus specifically on helping cancer patients understand and access viatical settlements. Speaking with a licensed provider can help you evaluate your options.

Ask AI

Want to explore more? Here are some prompts you can copy into your favorite AI tool:

- “Explain how viatical settlements work for cancer patients in simple terms.”

- “Compare viatical settlements and life settlements, and list pros and cons of each.”

- “What are the potential benefits and drawbacks of selling a life insurance policy during cancer treatment?”

- “How did the AIDS crisis of the 1980s lead to the creation of viatical settlements?”

- “Give me real-world examples of how patients have used viatical settlement funds.”