(A complete guide to unlocking the cash value of your life insurance when you need it most)

Cancer Care Financial created this guide to help individuals and families facing terminal illness understand how a viatical settlement works — and how it can provide immediate financial relief and peace of mind. When medical costs rise and time matters, knowing how to access the value within your life insurance policy can change everything.

What Is a Viatical Settlement?

A viatical settlement allows someone diagnosed with a terminal or chronic illness to sell their life insurance policy for a lump-sum cash payment. Instead of waiting for the policy’s future benefit, the policyholder receives funds now — while they can still use them for treatment, travel, care, or simply living with dignity.

Here’s how it works:

– You sell your life insurance policy to a licensed buyer (known as a viatical settlement provider).

– The buyer becomes the new owner and beneficiary.

– The buyer pays all future premiums.

– You receive an immediate lump-sum payment — usually much higher than your policy’s surrender value.

– When you pass away, the insurance company pays the policy’s death benefit to the buyer.

Viatical settlements are regulated, confidential, and designed to help people facing serious illness turn a life insurance policy into a powerful financial resource.

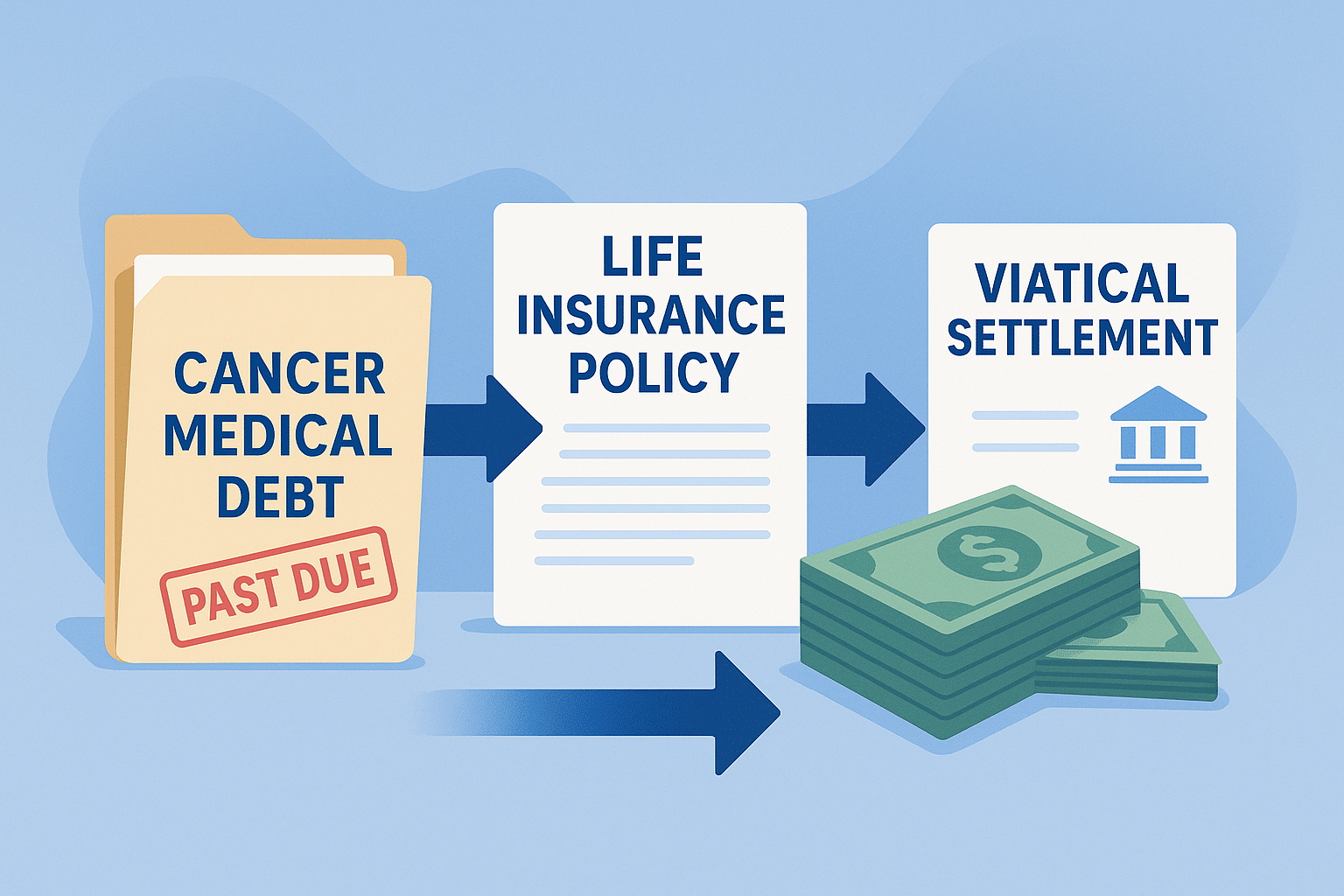

Why Viatical Settlements Matter for Terminal Illness

Immediate Financial Relief

A terminal diagnosis often brings overwhelming medical costs and uncertainty. A viatical settlement provides fast access to cash — allowing you to pay for treatment, reduce debt, or simply take control of your financial future.

Freedom to Choose Your Care

The money you receive is yours to use however you wish. Whether it’s covering hospital bills, funding integrative or experimental treatments, or fulfilling personal goals, a viatical settlement gives you the freedom to make choices on your own terms.

Eliminate Premium Obligations

Once you sell your policy, the buyer assumes responsibility for all future premium payments. You no longer need to worry about costly premiums at a time when every dollar counts.

Live With Dignity and Control

Beyond the financial impact, viatical settlements restore a sense of control — giving you and your loved ones the means to focus on comfort, quality of life, and peace of mind rather than financial strain.

Who Qualifies for a Viatical Settlement?

Viatical settlements are intended specifically for people with terminal or chronic illnesses. While eligibility can vary by state and provider, most qualifying cases include:

- A terminal illness diagnosis such as advanced or metastatic cancer.

- An active life insurance policy — typically $50,000 or more in face value.

- Whole Life, Universal Life, or Convertible Term policies.

- Premiums that are current and a policy that has been in force for at least two years.

- Consent from all policyowners and beneficiaries.

Even if your situation falls outside these general criteria, it’s often worth having your policy reviewed. Many exceptions exist depending on your diagnosis and policy structure.

How a Viatical Settlement Works: Step-by-Step

1. Consultation and Policy Review

A viatical settlement specialist or broker like Cancer Care Financial reviews your policy details, current health status, and life expectancy. This determines eligibility and estimated policy value.

2. Competitive Offers From Licensed Buyers

If you qualify, your policy is presented to licensed viatical settlement providers. Competing bids ensure you receive the highest possible payout.

3. Offer Review and Contract Signing

You review the offers, select the one that best fits your needs, and sign the agreement. Once finalized, ownership and beneficiary rights transfer to the buyer.

4. Payment and Premium Transfer

You receive your cash payment (often within weeks), and the buyer takes over all future premium responsibilities.

5. Completion of the Policy

When the insured passes away, the life insurance company pays the policy’s death benefit directly to the buyer. The transaction is fully complete, with no further obligations on your part.

Viatical Settlement process summary:

Policy review → Offers secured → Agreement signed → Payment issued → Buyer assumes premiums.

How the Value of a Viatical Settlement Is Determined

The amount you receive is based on several factors:

– Health of Insured: The more significant the health diagnosis typically leads to higher offers.

– Policy type and size: Larger death benefits often result in greater payouts.

– Premium costs: Lower ongoing premiums make the policy more valuable to buyers.

– Insurance company rating: Policies issued by strong, reputable insurers may attract better offers.

– Market conditions: Investor demand for viatical contracts can influence offer ranges.

Every policy is unique — which is why working with a trusted broker like Cancer Care Financial can help ensure your policy is valued accurately and competitively.

Is a Viatical Settlement Worth It?

For many individuals facing a terminal illness, a viatical settlement can be one of the most meaningful financial decisions they’ll ever make. It provides immediate liquidity, removes ongoing medical billsn, and gives you the flexibility to decide how your remaining time and resources are spent.

If your policy is no longer needed or the premiums are a burden, a viatical settlement can turn that policy into tangible financial strength — now, when it matters most.

Key Benefits of a Viatical Settlement

- Immediate access to cash when you need it most.

- No future premiums — all obligations transfer to the buyer.

- Funds can be used for anything — from medical care to travel, family support, or comfort.

- Potentially tax-free payout for individuals with a certified terminal illness (consult your tax professional).

- Confidential, regulated process ensuring fairness and consumer protection.

A viatical settlement isn’t just a financial transaction — it’s a lifeline that helps patients live on their own terms.

Are Viatical Settlements Tax-Free?

In most cases, yes. Under the Internal Revenue Code (Section 101(g)), proceeds from a viatical settlement are not taxable if the insured has been certified by a physician as terminally ill. However, if the insured’s condition is classified as chronic rather than terminal, or if the transaction is unlicensed, taxation could apply.

Always consult a tax advisor to confirm your specific situation before finalizing a sale.

Important Considerations Before Selling Your Policy

- Loss of death benefit: Your beneficiaries will no longer receive the policy’s payout.

- Privacy and health records: Buyers require access to medical information to assess policy value.

- Impact on public benefits: A large cash payment could affect Medicaid or SSI eligibility.

- Tax implications: While most terminal illness settlements are tax-free, verify your status under IRS Section 101(g).

- Choosing a licensed company: Always ensure your broker or provider is licensed and transparent about fees and timing.

Common Questions About Viatical Settlements

Is a viatical settlement legal?

Yes. Viatical settlements are legal and regulated in nearly every U.S. state, with consumer protection laws governing licensing and disclosure.

How quickly can I get paid?

Most viatical settlements close within 2–6 weeks once required documents are received.

Do I have to use the funds for medical purposes?

No. You can use the money however you wish — it’s your cash, with no restrictions.

Will I owe taxes on the money I receive?

If you are terminally ill and meet IRS guidelines, your proceeds are typically tax-free.

Can I sell a term life policy?

Yes, if it is convertible to permanent coverage. Non-convertible term policies usually do not qualify.

How do I know I’m getting a fair offer?

Work with a licensed viatical settlement broker such as Cancer Care Financial who can solicit multiple bids to ensure maximum value.

Is my privacy protected?

Yes. All personal and medical information shared during the process is strictly confidential and protected by law.

When a Viatical Settlement Makes Sense

If you are living with a terminal illness and have an active life insurance policy, a viatical settlement can be a meaningful source of relief — both financially and emotionally. It can help pay for treatments, fulfill lifelong goals, or simply ease the burden on loved ones.

At Cancer Care Financial, we’ve helped countless individuals and families turn their life insurance policies into immediate financial support during life’s most challenging moments. Our mission is to provide honest guidance, fair value, and compassionate support every step of the way.

To find out if you qualify for a viatical settlement, contact Cancer Care Financial at 844-440-7355 for a free and confidential evaluation.