Scottsdale, Ariz. — When patients first arrive at Envita Medical Center, they often come carrying more than a diagnosis. They bring binders of medical records, stories of treatments that didn’t work, and the weight of insurance companies that refused to pay for the care they believe in.

Envita, founded by Dr. Dino Prato, NMD, has built a national reputation as one of the few clinics in the United States offering precision, integrative cancer care. Its programs combine advanced diagnostics, immunotherapy, and conventional oncology with nutrition, detoxification, and supportive therapies. The approach is deeply personalized — designed to strengthen the patient’s immune system while targeting the cancer.

For many, finding Envita represents hope. But hope collides with a stubborn barrier: cost.

The Financial Wall Patients Hit

Cancer treatment is expensive everywhere. But when care moves beyond the boundaries of what insurance considers “standard,” the gap widens quickly.

Insurance may cover imaging scans or blood work. But the cornerstone of Envita’s approach — genetic testing, targeted immunotherapy, and complementary therapies — often falls outside the definition of “medically necessary.” That means patients must pay out of pocket.

For families, the choices are stark:

– Empty retirement accounts.

– Take out risky loans or second mortgages.

– Turn to online fundraising.

– Or walk away from the treatment they believe offers their best chance.

It’s a decision that compounds stress at the very moment patients need clarity and focus.

A Financial Path Hiding in Plain Sight

Many patients already own an asset that can solve the problem: their life insurance policy.

“It’s like discovering you’ve been sitting on a piece of property you never thought you could use,” says Justin Friedman, CEO of Cancer Care Financial. “That piece of paper — your life insurance policy — can be sold for immediate cash.”

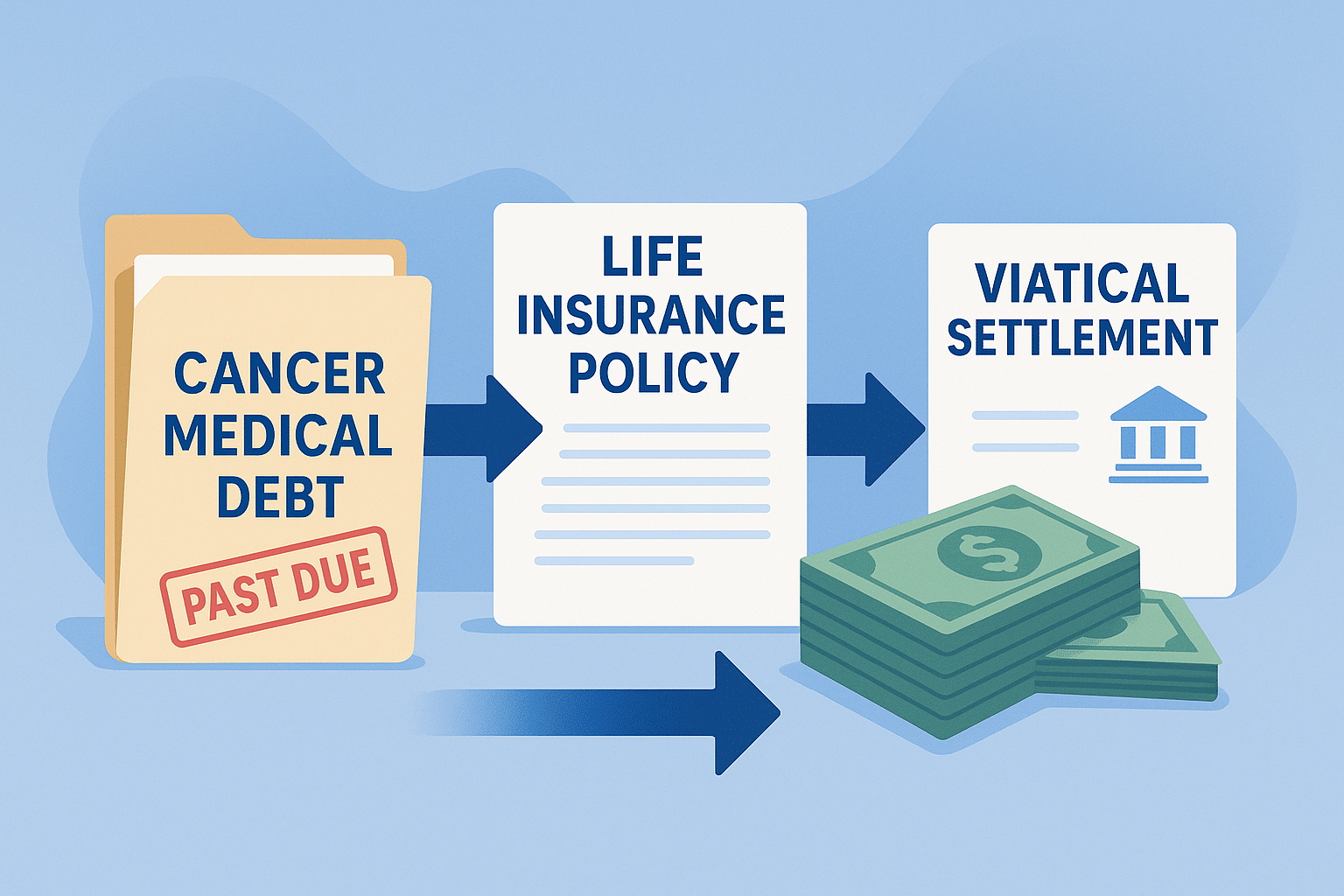

The practice is called a viatical settlement. Patients with a serious illness can sell their life insurance policy to a licensed buyer. The buyer becomes the new owner and beneficiary, taking over premium payments. The patient receives a lump sum in cash, often within weeks.

Unlike loans, there’s no repayment. Unlike accelerated death benefits, there are no restrictions on how funds can be used. The money is immediate, unrestricted, and — for qualifying illnesses — typically tax-free.

How the Process Works

Cancer Care Financial specializes in guiding patients through this process with speed and compassion. Friedman describes it as less about paperwork and more about partnership.

“We talk often throughout the process,” he says. “Patients are kept updated on every offer that comes in. When multiple buyers bid, it sometimes turns into a bidding war — and that can mean a huge number for the patient.”

The steps are straightforward:

1. Policy review — Cancer Care Financial evaluates whether the life insurance policy qualifies. Many types and face values can be considered, often starting at $50,000.

2. Offers collected — Licensed buyers review the policy. The patient sees every offer, ensuring transparency.

3. Selection and paperwork — The patient chooses the best offer. Cancer Care Financial handles the paperwork, keeping communication clear.

4. Funding — Cash is deposited directly into the patient’s account, often within four weeks.

The funds can cover treatment at Envita, travel and lodging in Scottsdale, daily living expenses, or simply the peace of mind of knowing financial pressure has lifted.

“When those funds arrive,” Friedman says, “the patient can move forward, and their family can focus on what matters most: healing.”

Why This Matters for Envita Patients

Envita’s philosophy is rooted in access. Dr. Dino Prato, the center’s founder, has spoken often about the need to remove barriers to cutting-edge care. Insurance programs, he argues, lag behind the science and prevent patients from reaching treatments that could help them.

That’s why Envita’s model emphasizes precision diagnostics and integrative strategies — to give patients tools beyond the one-size-fits-all protocols of conventional care. But the very innovation that defines Envita is what insurance routinely denies.

This is where viatical settlements align so closely with Envita’s mission. Cancer Care Financial doesn’t provide treatment — but it makes treatment possible by removing the financial roadblock.

“So many patients at Envita tell me I’ve changed their life,” Friedman says. “I feel like I’m just opening a door they didn’t know could be opened. To hear someone say that is an incredible honor. That’s why I’m here, and why Cancer Care Financial exists.”

Focus on Healing, Not the Bills

A cancer diagnosis overwhelms patients with questions: What treatment is right? Who should I trust? What comes next? Adding How do I pay for this? to the list can feel unbearable.

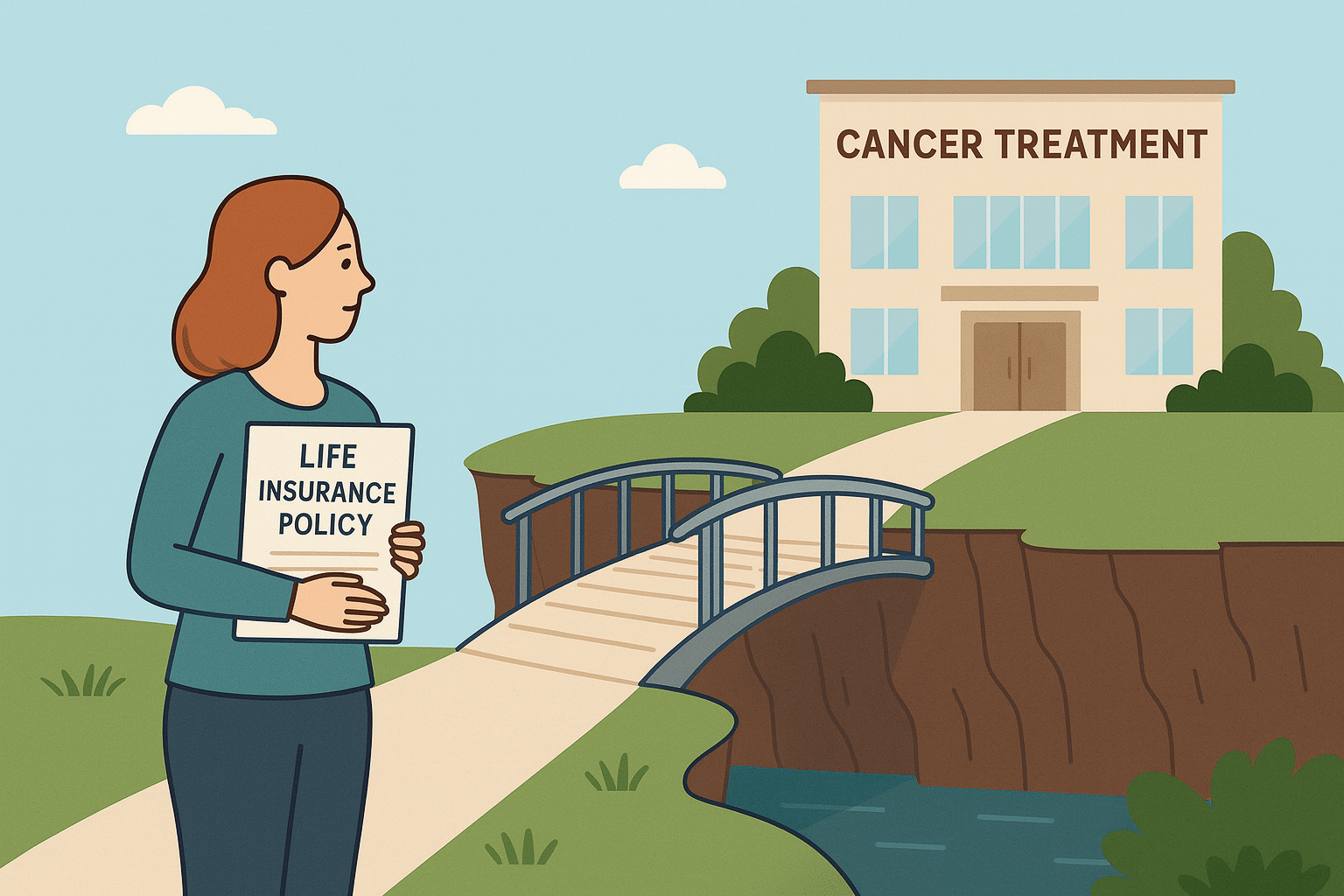

By converting a life insurance policy into cash, patients can take cost out of the equation. They can book their care at Envita, secure housing for extended stays, and manage the everyday realities of life without financial panic.

“While not everyone qualifies — you need to have a life insurance policy — for those who do, learning about this option changes everything,” Friedman says. “It gives peace of mind that at least one part of the journey is taken care of. You can focus on healing, not the bills.”

Key Takeaway

Envita Medical Center provides advanced, integrative cancer care that insurers rarely cover. A viatical settlement through Cancer Care Financial turns a life insurance policy into immediate, unrestricted cash — covering treatment, travel, and living costs. For families choosing Envita in Scottsdale, it’s the financial bridge between hope and action.

People Also Ask

What is a viatical settlement?

The sale of a life insurance policy by someone with a serious illness in exchange for an immediate lump-sum cash payment.

How quickly can funds be received?

Most patients receive money within two to four weeks of approval.

Are proceeds taxable?

For qualifying illnesses, viatical settlement proceeds are generally tax-free. Always confirm with a tax advisor.

Do I lose my life insurance policy if I sell it?

Yes. The buyer becomes the beneficiary and takes over premium payments. In return, the policyholder receives cash now.

FAQ

Q: Can viatical settlement funds be used for more than treatment?

Yes. Funds are unrestricted and can be used for travel, housing, nutrition, or daily living costs.

Q: How is a viatical settlement different from accelerated death benefits (ADB)?

ADB is controlled by the insurance company and often capped. A viatical settlement invites multiple licensed buyers to bid, which can lead to higher offers.

Q: Who qualifies for a viatical settlement?

Patients with a serious illness and a life insurance policy valued at $50,000 or more may qualify.

Q: How does Cancer Care Financial help patients at Envita specifically?

CCF doesn’t speak for Envita or set its prices, but it removes the financial barrier that stops patients from beginning treatment at Envita.